Are you Prepared for Making Tax Digital for VAT?

Now all VAT registered businesses have to use Making Tax Digital for VAT, we give a heads up on what you need to do

Below we answer common questions about Making Tax Digital for VAT (MTD for VAT).

What is Making Tax Digital for VAT?

Making Tax Digital for VAT is a service that was implemented by HMRC in April 2019. It's aim was to force VAT registered businesses to keep and submit VAT figures digitally in order to reduce manual errors.

Who needs to use Making Tax Digital for VAT?

In April 2019 only VAT registered businesses with a turnover greater than £85,000 needed to use MTD for VAT. For VAT periods starting on or after 1 April 2022, all VAT registered businesses need to use MTD for VAT to submit their returns.

How do I comply with MTD for VAT?

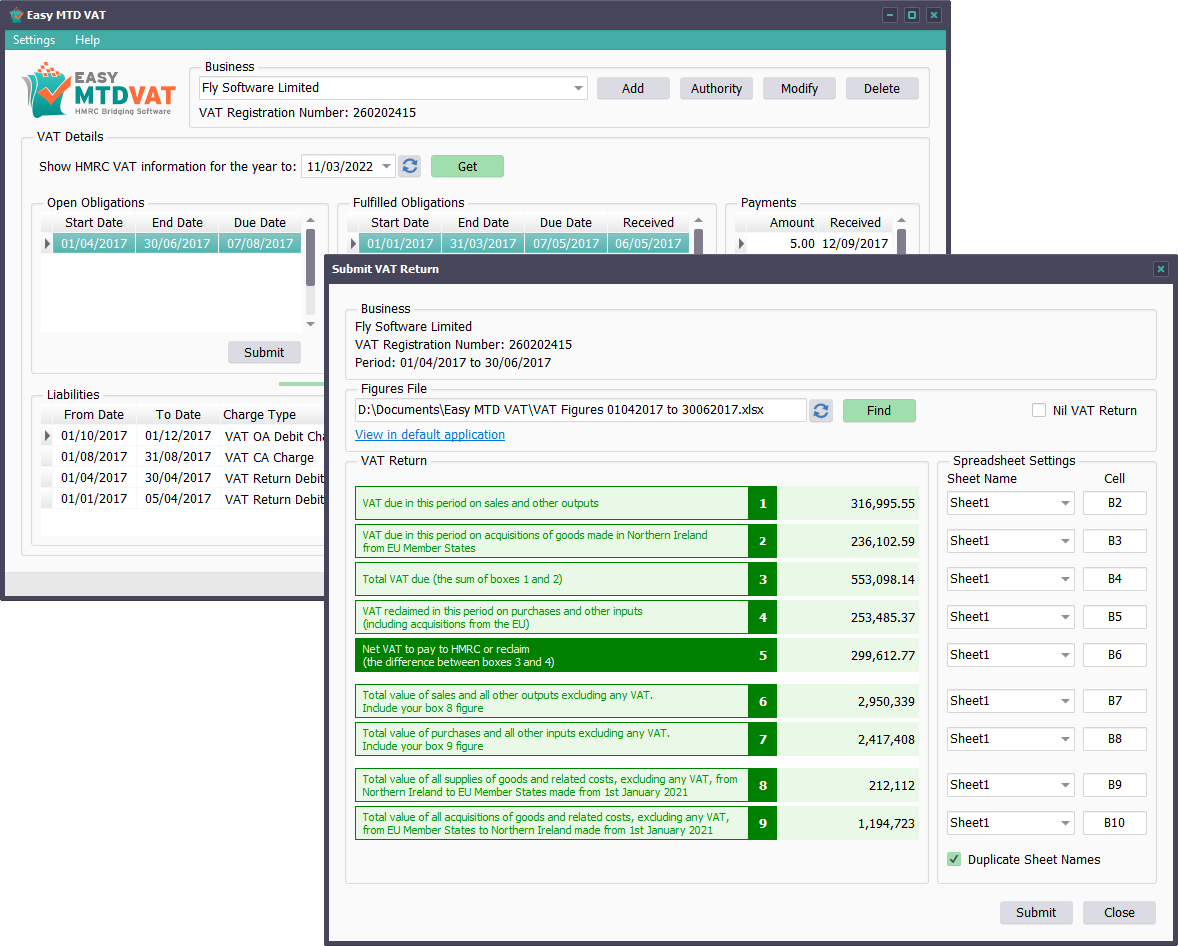

To comply with MTD for VAT, a full digital link between the software you use to record your business figures and HMRC must be maintained. This means figures can no longer be copied and pasted or typed, and MTD compatible software such as Easy MTD VAT must be used to transmit them to HMRC.

Can I still carry on using a spreadsheet?

If you record your business figures in a spreadsheet, don't worry, you can continue to do so. The only change to your current system will be using bridging software such as Easy MTD VAT to submit the 9 box figures of a VAT return to HMRC.

My accounting software isn't MTD for VAT compliant. Can I continue using it?

If your accounting software isn't MTD for VAT compliant, chances are you can still continue to use it alongside bridging software such as Easy MTD VAT. As long as the software can export the 9 box figures to an Excel spreadsheet (xlsx, xls), text (txt) file or comma separated values (csv) file, you are good to go.

Upgrading my accounting software so it works with MTD for VAT is expensive, is there an alternative?

Accounting software is often costly to use and having to pay extra to make it MTD for VAT compliant adds insult to injury. However, as long as your software can export the 9 box figures to an Excel spreadsheet (xlsx, xls), text (txt) file or comma separated values (csv) file, you can use bridging software such as Easy MTD VAT to submit a VAT return to HMRC.

What is bridging software?

Bridging software such as Easy MTD VAT provides a digital link between HMRC and your VAT figures held in a spreadsheet or an accounting package that isn't MTD for VAT compliant. The software maintains a digital link making you 100% compliant with HMRC's new rules.

Is it true that using bridging software won't always be allowed?

This rumour was spread by certain software developers wanting to drive more customers to their accounting software. HMRC gave their knuckles a rap for this blatant lie and have stated that bridging software such as Easy MTD VAT will continue to be a valid MTD for VAT solution.

You can read more about this here.

Why should I use Easy MTD VAT?

Here's a handful of reasons why you should use Easy MTD VAT as your MTD for VAT solution:

- 100% compliant with MTD for VAT and listed on the HMRC Find Software web page.

- Install in seconds. Start submitting VAT returns in minutes.

- Compatible with VAT figures held in an Excel spreadsheet (xlsx, xls, xlsm), text (txt) file or comma separated values (csv) file (or any spreadsheet or accounting software that can export to these formats).

- An installed application not an Excel plugin means no fiddly integration or configuration and you don't need to be an Excel power user or even an Excel owner.

- First class and prompt support with a personal touch.

- Inexpensive... submit VAT returns from as little as £1.80+VAT (your first VAT return is FREE).

- Tried and tested - Easy MTD VAT has already submitted over 49,000 VAT returns to HMRC.

- Can be used by businesses and agents.

- Compatible with any scheme.

- Regularly updated so you can be certain it conforms to the latest HMRC changes and requirements.

When do I need to start using Making Tax Digital for VAT?

Now! All VAT registered businesses need to use MTD for VAT (although you can apply to HMRC for exemption). The online method businesses previously used to submit VAT figures was removed in Novermber 2022 so MTD for VAT is now the only way.

How do I get started?

All you need to do is download, install then launch Easy MTD VAT; configure it for your business or, if you're an agent, configure it for the businesses you manage; grant authority to it then off you go... you'll be submitting your first VAT return in minutes! And if that isn't enough to get you making the jump to MTD for VAT today, we'll even allow you to submit your first VAT return without spending a penny!

Click here to find out more about Easy MTD VAT and why businesses have used it to submit thousands of VAT returns without changing the way they record their business figures.

NOTE: This article was originally published in February 2021 and has since been updated for the April 2022 deadline and changes made to the registration process in November 2022.