First Glimpse at Easy MTD

Take a look at how Fly Software's new bridging software - Easy MTD - will allow you to comply with Making Tax Digital for Income Tax and Making Tax Digital for VAT without changing the way you work

Fly Software's Easy MTD is being developed as a two-in-one Making Tax Digital (MTD) bridging solution for individuals, businesses, and agents. Designed for convenience and compliance, it enables users to manage both MTD for Income Tax and MTD for VAT within a single, easy-to-use Windows application.

One Solution for MTD for Income Tax and VAT

Scheduled for an initial release in January 2026, Easy MTD will include the same trusted VAT submission functionality found in Fly Software’s Easy MTD VAT application - that Easy MTD will replace. In addition, it will introduce new features for submitting quarterly updates and other Income Tax data ahead of HMRC’s Making Tax Digital for Income Tax (MTD IT) rollout in April 2026.

At launch, Easy MTD will support VAT return submissions and provide access to VAT liabilities, payments, and penalties. The Income Tax functionality will be introduced in stages throughout 2026 to ensure full HMRC compliance and a smooth user experience.

HMRC are still applying the finishing touches to MTD for Income Tax, so here at Fly Software we're not yet ready to release Easy MTD with Income Tax functionality", states Sam Jones, Marketing Coordinator for Fly Software. "Prior to 6 April 2026 Easy MTD will have an update that will allow quarterly updates to be submitted. Throughout the year other Income Tax features will be introduced until Easy MTD provides a full end-to-end MTD for Income Tax solution for taxpayers and agents."

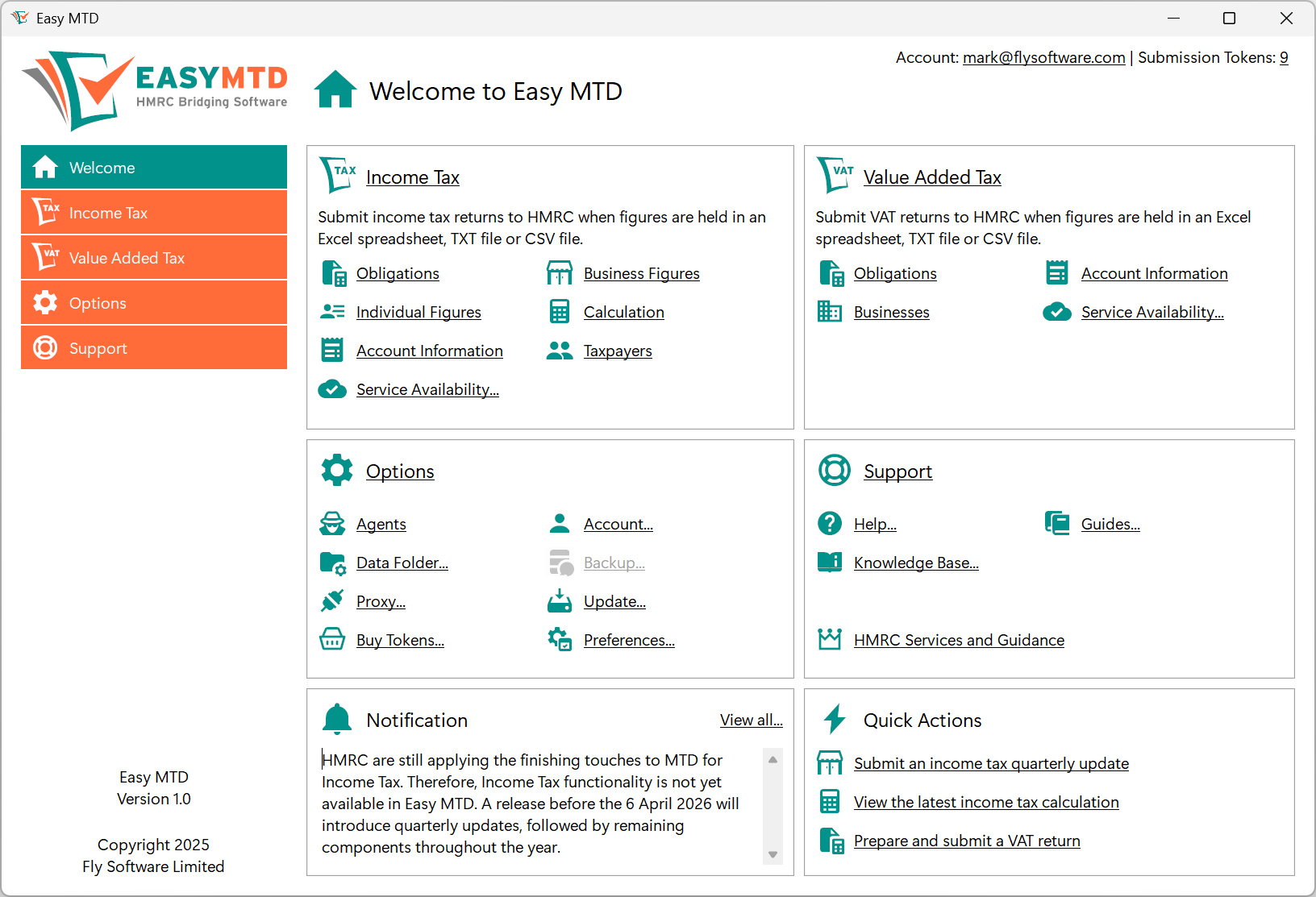

The Easy MTD interface showing the Welcome section

Proven and Trusted Functionality

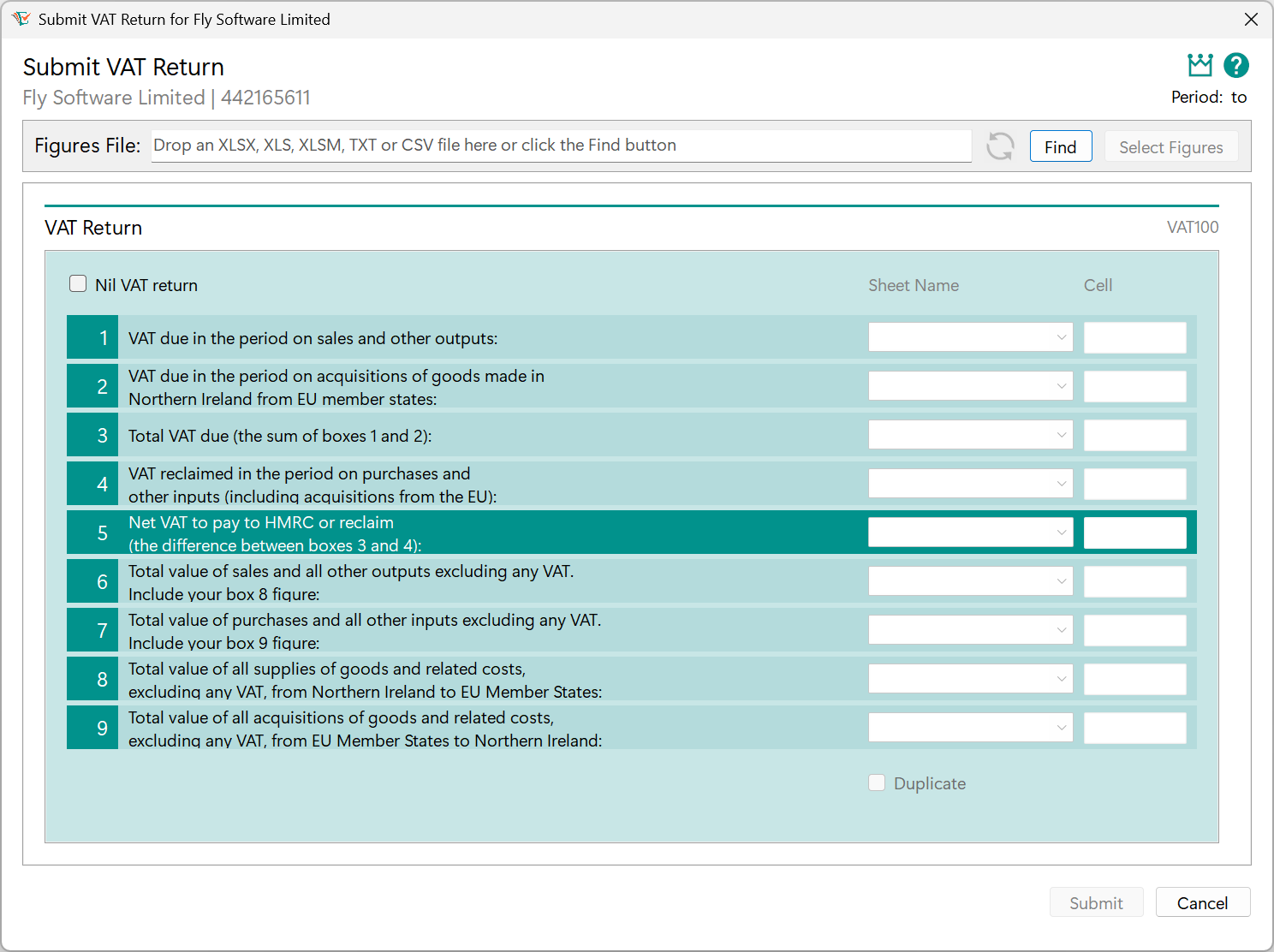

The VAT submission process of Easy MTD remains faithful to Easy MTD VAT. It shows the 9 VAT figures and their descriptions and provides functionality to select an Excel, text or csv file, and specify where in a selected spreadsheet the VAT figures appear.

The Easy MTD Submit VAT Return window

Introducing Quarterly Updates for MTD for Income Tax

One of the first MTD for Income Tax features to be released will be the much-anticipated (or feared) quarterly updates. Taxpayers will need to submit these updates four times per year for each of their self-employment and/or property businesses. The required data includes business income, a breakdown of expenses, and details of disallowable expenses. For businesses with an annual turnover below £90,000, only income and a single consolidated expenses figure will need to be submitted.

Similar to Easy MTD VAT, users will prepare their quarterly figures in spreadsheets or other software, before Easy MTD extracts and submits them in line with HMRC's digital link rules.

Additional MTD for Income Tax Features

Further Income Tax functionality within Easy MTD will include the ability to input and submit:

- An annual summary, accounting adjustments, and any carried-forward losses for each self-employment and/or property business.

- Personal financial information such as employment income, dividends, pensions, state benefits, savings interest, tax reliefs, and deductions.

- A final declaration confirming that the taxpayer agrees with HMRC's generated tax calculation.

Tailor Tax Return – Simplifying MTD for Income Tax Submissions

The amount of data required for Making Tax Digital for Income Tax far exceeds that for VAT. To simplify this process, Easy MTD will feature a "Tailor Tax Return" tool. This feature allows users to select only the sections of their tax return relevant to their circumstances, reducing complexity and making it easier to track progress before making a final declaration.

Transitioning from Easy MTD VAT to Easy MTD

When Easy MTD launches, it will instantly replace Easy MTD VAT, with existing users transitioning seamlessly using an update. A further release before April 2026 will add core Income Tax functionality - including quarterly updates - followed by other releases throughout the year, culminating in a fully compliant bridging solution for both MTD for Income Tax and MTD for VAT.

Simple Token System for Submissions

Easy MTD will use the same simple and cost-effective token mechanism currently applied to Easy MTD VAT:

- VAT Return Submission: One token per VAT return per business.

- Quarterly Update Submission: One token per taxpayer per quarter (not per business).

- Final Declaration: One token per taxpayer per tax year.

The cost per token is as low as £2+VAT, making Easy MTD one of the most inexpensive solutions for submitting Income Tax and VAT.

No Change to the Way You Work

Like Easy MTD VAT, Easy MTD supports figures recorded in an Excel, text or CSV file. This means you can continue using your tried and tested spreadsheets or software that isn't compatible with MTD. There is no need to move to expensive and complicated accounting software.

The Go-To Software for Making Tax Digital Compliance

Easy MTD aims to become the leading Making Tax Digital bridging software for both Income Tax and VAT. With all the features taxpayers, businesses, and agents need to comply with HMRC's digital requirements, Easy MTD will provide a complete, user-friendly solution for everything Making Tax Digital.

Get Notified When Easy MTD is Launched

Users of Easy MTD VAT will be notified prior to the initial launch of Easy MTD, and will be ushered towards changing from their existing software to the new.

If you're not an existing user and you require an MTD for Income Tax compliant bridging solution ready for April 2026, then let us know using our contact form and we'll be sure to email you as soon as Easy MTD is ready. In the meantime, visit easymtd.com to find out more about how Easy MTD can be used to comply with both MTD for Incoem Tax and MTD for VAT.