!Easy MTD allows you to comply with HMRC's Making Tax Digital for Income Tax (coming soon) and Making Tax Digital for VAT while still using a spreadsheet or incompatible accounting software.

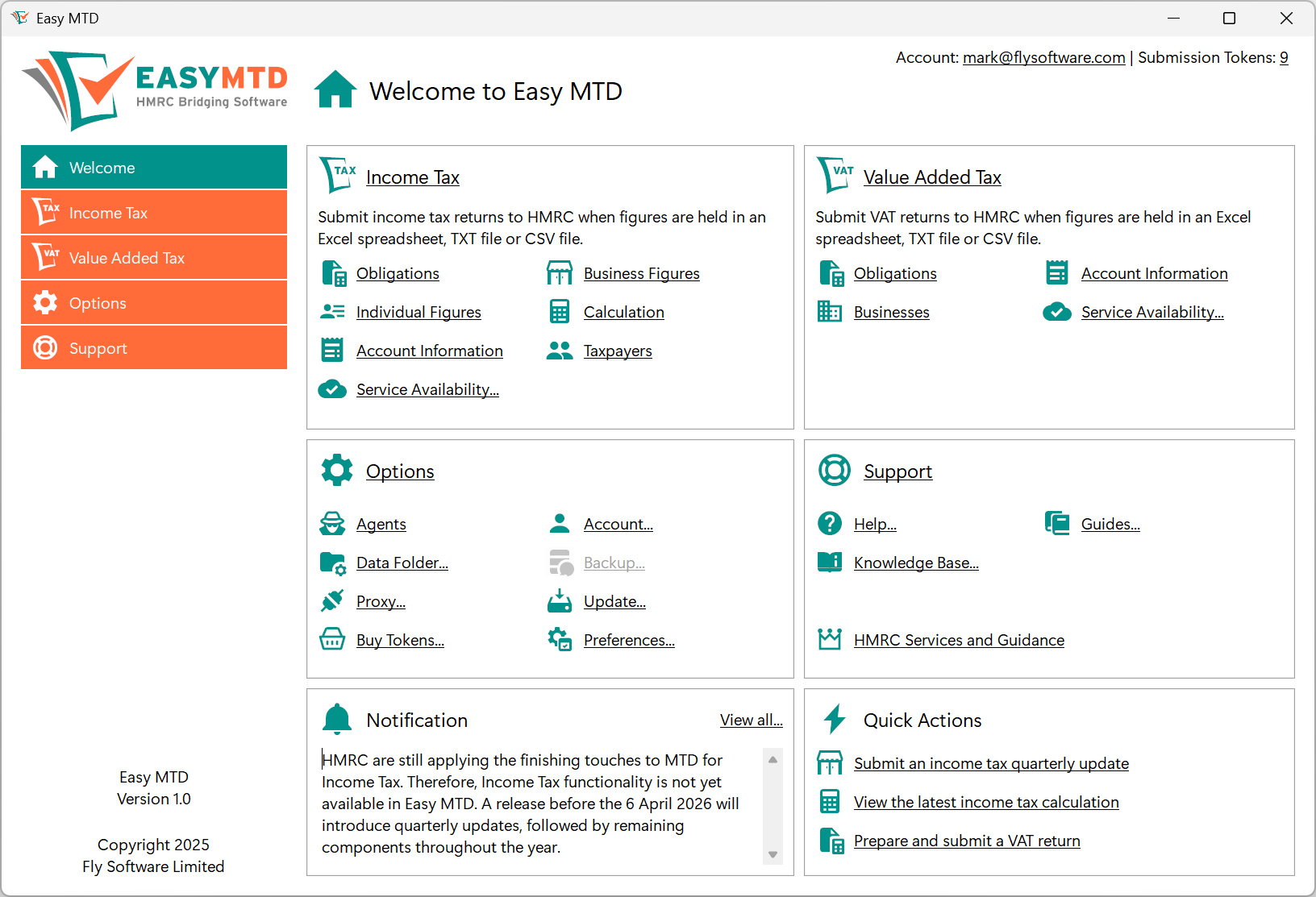

If your Income Tax or VAT figures are stored in an Excel, text or CSV file, or software that can export to one of these formats, Easy MTD can be used to submit them digitally to HMRC in just a few clicks. Not only that, Easy MTD also allows you to manage and view the Income Tax and VAT information held by HMRC so you know exactly what you need to do and when without signing in to your HMRC online services account.

If you need to submit just one or one hundred quarterly updates, final declarations or VAT returns to HMRC, our token-based system makes !Easy MTD one of the most cost effective MTD solutions available. We'll even gift you a free token when you sign up for an account so your first submission won't cost you a penny.

Download !Easy MTD and start managing and filing Income Tax and VAT in compliance with Making Tax Digital.

!Easy MTD will soon replace Easy MTD VAT.

Manage and file Income Tax and VAT under Making Tax Digital - no need for two different solutions.

!Easy MTD can submit Income Tax and VAT figures held in an Excel, txt or csv file meaning it can act as a bridge between almost any accounting system and HMRC.

The !Easy MTD interface is so straightforward your Income Tax and VAT filing needs can be satisfied in minutes.

!Easy MTD is compliant with HMRC's Making Tax Digital (MTD) platform and is listed on the HMRC "Find Software" web page.

Manage Income Tax and VAT without cost, and buy tokens from as little as £2 + VAT to submit quarterly updates, final declarations and VAT returns to HMRC.

Whether you're an individual taxpayer, a VAT registered business or a tax agent or accountant, !Easy MTD is the perfect MTD solution.

Copyright © 2026 Fly Software Limited. All Rights Reserved.

You have been sent an email to reset your password. If you can't find it, check your spam/junk folder.